Disclaimer: this blog post was put together for informational purposes only based on our review and analysis. This should not be construed as a solicitation, offer, or recommendation to acquire or dispose of any investment, engage in any transaction.

By Andrea Bonaceto, FRSA — Partner at Eterna Capital & Artist

Special thanks for early feedback and comments to: Addie Wagenknecht, Pablo-Rodriguez-Fraile, Vincent Harrison, Yasmine Bencherif, Skygolpe, Giacomo Caniparoli and Federico Morescalchi.

INTRODUCTION

As human beings, we are constantly in interaction with the world that surrounds us. A defining characteristic of the physical world in which we live is diversity. Look around you, each element is unique. From the trees in a forest to houses in a crowded city, absolutely everything possesses specific attributes that contribute to making that particular thing one of a kind.

The internet has launched the digital era. This has opened up an ocean of opportunities for the digital society in which we live today — but can we really represent any asset of the real world into the digital world?

Let’s place a mirror in front of the real world and observe its reflection. Its projection is a parallel digital world (called “Metaverse”) where humans are conceptualized as avatars and where all visible objects in there are unique, non-fungible items represented by a new technological protocol called “Non-Fungible Token” (NFT).

It might sound like science fiction, but we are at the cusp of a paradigm shift. NFTs will revolutionize many industries, especially the creative industry/economy. By leveraging NFTs as a tool, it will now be possible to represent everything we see in our world in a digital form, doing so with a unique immutable identity attached to the blockchain. This will give rise to new business models underpinned by these latest technologies.

The latest generation, commonly referred to as “Gen Z”, represents the first digital native wave — they have never experienced a world without the internet. Gen Z places authenticity and creativity as some of their most important values. Data suggests this generation will resonate very well with NFTs [1].

Today our society is dominated by rationality. People fully identify with their jobs — people are the job they have. However, statistics show that 85% of people are actually unhappy in their job [2]. In our frenetic and competitive society, there is very little time for creativity and for truly expressing who we really are.

In his work “The Birth of Tragedy”, German philosopher Friedrich Nietzsche defined the equilibrium between rationality and creativity as the perfect balance of an ideal society. NFTs could act as a catalyst to help society achieve this balance. This could be the dawn of a new Renaissance, springing straight after a global pandemic — reminiscent of the 15th century Renaissance that arose in the immediate aftermath of the plague.

WHAT IS AN NFT? ADDRESSING A COMMON MISCONCEPTION

Let’s start with the difference between a Fungible Asset and a Non-Fungible Asset.

Fungible Asset — an asset that can be interchanged with other individual goods or assets of the same type. Fungible assets within the same category are identical to one another and serve the same purpose. A few examples of fungible assets are commodities, common shares, options, dollar bills etc.

Non-Fungible Asset — an asset that is unique for the qualities it has. Each asset unit does have unique qualities that add or subtract value to the asset itself. In simple terms, assets are different from one to another. This is true for the vast majority of things we own/interact with on a daily basis. A few examples of non-fungible assets are artworks, diamonds, land, collectible cards etc.

In the blockchain space, utility and security tokens are fungible assets. All the Ethereum ERC20 tokens are identical to one another — same for all the other main cryptocurrencies.

However, what if we could give each token unit unique characteristics so that each token is actually different from the other? By doing this we have the so-called ERC721 token, commonly known as Non-Fungible Token (NFT).

“NFTs are unique, digital items with blockchain-managed ownership.

Examples include collectibles, game items, digital art, event tickets,

domain names, and even ownership records for physical assets” [3].

Before we dig deeper into analysing NFTs, let’s address a common misconception. As mentioned previously, NFTs are often representing things like collectibles and digital art, very often in the form of digital images or videos. Newcomers often ask “why would someone pay a lot of money for something that seems like it could be easily copied?”.

This question was asked to PAK, one of the leading NFT digital artists, during a podcast hosted by a16z. This was PAK’s reply:

“You see, that’s a tricky question. Because the newcomer assumes that it can be copied but in reality, the collector of the NFT does not obtain a digital file, they get a unique and signed token that cannot be copied or owned by anyone else. So, assuming that NFT’s can be right-click-save-as copied is very similar to the assumption of going to the Louvre to take a picture of Mona Lisa to own it, or taking a picture of a plane ticket to copy it. NFT is not about the visible object, it’s about the permission and access to a thing.

It’s only a matter of time until it becomes accepted in a wider sense. Every new medium for art had this struggle for acceptance. Having this struggle is not bad, it’s good. When the argument is over, this conflict and resolution will be the thing that will make crypto-based art valid. From my personal perspective, this is not a conflict or questioning of “is this art or not.” It’s more of a questioning of “is this unique enough or not.” And sooner or later it will be understood” [4].

MAIN NFT CATEGORIES

At the time of writing, NFTs global trading volumes since inception are roughly $878 million [5]. NFTs can be grouped in the following categories:

1. DIGITAL ART

With an estimated 49% share of total NFTs trades, Art is compiling around $429 million in volume.

This traffic is very much prompted by the emergence of a movement known as “Cryptoart”, although it is still in its infancy. Whether it is set to become a distinct mainstream art trend like Pop Art, Street Art etc. with its own aesthetical connotations, or even whether Crypto Art and Art become one (dropping the crypto prefix), the jury has yet to decide where the realm of digital art space is headed. Whatever your views are on this matter, NFTs and digital art are now entwined and will be around for the long haul. Most recently even traditional blue-chip artists have started looking at the NFT space with interest.

Advances in modern technologies such as high-definition screens, projectors, VR headsets are evolving by leaps and bounds. So it is no wonder that the fruition of artworks in digital form is a growing trend.

Among other things, the digital format allows the display of an artwork on a high-definition monitor. It offers many benefits including the ability to change the artwork displayed on the monitor with ease and to support more elaborated media such as video, music, animations etc.

Another interesting feature lies in the possibility of customizing the NFT attached to the digital artwork whereby the artwork changes in the occurrence of specific external events. For instance, “EthBoy’’ by Trevor Jones depicts Ethereum’s creator Vitalik Buterin. Dependent on external factors, the portrait undergoes modifications resulting from sporadic events including price fluctuations, gas fees, — an accessory layer connected to one of Vitalik’s wallet address — but also annual changes triggered by Vitalik’s birthday and the initial release of the Ethereum system [6].

The NFTs are also putting a foot in the political arena. Beeple, the most well-known digital artist, has produced a mutating portrait of Donald Trump customizing the NFT to change based on the outcome of the 2021 US election. That artwork originally acquired by art collector Pablo Rodriguez-Fraile for $67,000 in October 2020 was sold 5 months later on the secondary market for $6.6 million.

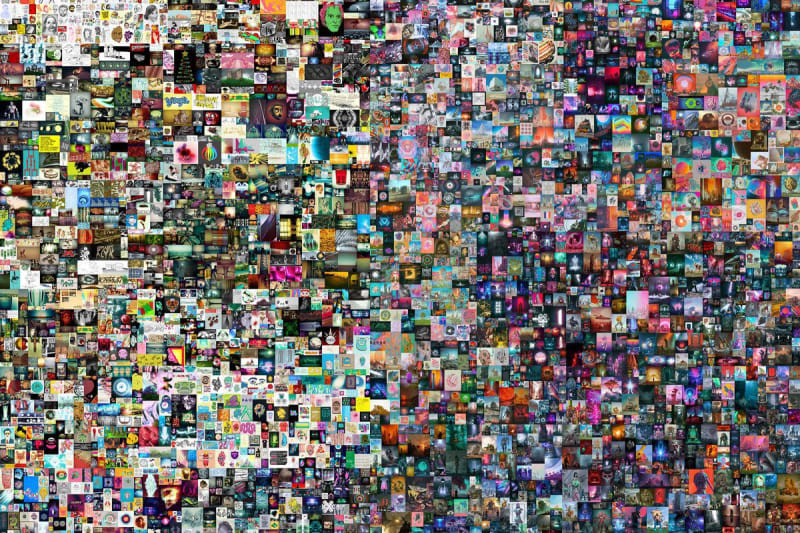

Beeple is the first artist to auction a purely digital, NFT-backed artwork at a major auction house. The artowrk titled “Everydays — The First 5000 Days” was sold for a record-breaking $69.3m on the 11th of March 2021 [7].

Hybrid art medium models are also rapidly emerging. As an example, the artist 3LAU has already piloted a hybrid between visual art and music with the first ever full-length tokenized song sold on Nifty Gateway [8] and tokenized music album sold on Origin Protocol, an Eterna Capital portfolio company. In a nutshell, the artist’s creativity is the only limit on what can be achieved through NFTs.

On Cryptoart.io you can find who are the most prominent digital artists, most popular digital artworks as well as some of the major NFT-based exchange platforms to trade NFT digital art e.g. Nifty Gateway, SuperRare, MakersPlace, AsyncArt, KnownOrigin and Foundation. Each platform has its own twists, so the best way to understand the differences is to try them out.

NFTs are also applicable to the physical art space. NFTs can streamline the process of physical art authentication. Linking an NFT to a physical artwork guarantees the provenance and authenticity of the artwork as that information will be stored in an immutable and transparent manner on the blockchain. Every time the artwork changes hands, that transaction will also be recorded on the blockchain.

The traditional art industry relies on manual authentication processes, which are very weak against forgeries. In an AFP report, Geneva-based FAEI’s chief Yann Walther contends that 50% of works of art circulating on the market are counterfeit or misattributed and are probably at the conservative end of the spectrum. [9] Furthermore, NFTs also serve as a medium for the collection of an artist’s royalties. You can customise the NFT such that, for instance, 10% of the artwork sale price will automatically accrue to the creator every time the artwork is sold on the secondary market.

This is a very compelling value proposition, since artist in the current commercial world don’t get any royalties on secondary market sales unless they are selling directly to the auction houses, which is very uncommon as it is typically a collector or gallery who places the artworks. Normally only very established artists have royalties on secondary market sales as part of their sale contracts — with NFTs we now have a cryptographically secure way to ensure every artist receive some return on their works when resold. This contributes to make the art market more inclusive and fairer for creators.

2. GAMING

Gaming, an area destined to emerge as one of the main outlets for NFTs, represents 11% of overall NFTs trading volumes, amounting to around $95 million [10] since inception.

The exponential rise of in-home gaming in the face of the pandemic coupled with the expanded functionality that NFTs are bringing to games i.e., a new enhanced and more immersive user experience, will trigger a substantial growth of the NFT gaming market. According to Newzoo, the NFT gaming sector is set to grow at 9.6% p.a. in the coming five years.

Epic Games made $2.4 billion in revenue selling costumes in their free-to-play game Fortnite in 2018 alone, the market for event tickets is projected to reach $68 billion in 2025, and the market for domain names continues to see solid growth [11].

The difference between the items in Fortnite and an NFT is simple: True ownership. Digital property rights. The buyer of that NFT never has to worry that some company in the cloud is going to stop their service or freeze their account [12].

NFTs in the form of character attributes, costumes or rare objects can have specific functionalities within each game. If the game becomes mainstream, rare NFTs sold in the game could also become extremely desirable by the game users.

Gamers being the principal concerned, the NFTs are likely to resonate with them due to their existing familiarity with the virtual world and “ownership” of virtual goods. In addition, the Endowment Effect, a phenomenon in which people tend to place more value on something they own, is an even greater rationale for NFTs. This will in turn, extend the capabilities of the burgeoning digital economy in which individuals exchange goods seamlessly and with the assurance that they will own them for the long haul.

For this reason, long-standing gaming giants are considering introducing NFTs into their technology. For example, French company Ubisoft has launched an initiative called Sorare — a fantasy football blockchain-based game — and RedFox Labs is looking to launch a new Roblox that supports NFTs. The influx of big corporations in the space will foster adoption across traditional gaming devices such as PC, Xbox and PlayStation, e.g., Goati’s 22 Racing Series.

Some popular NFTs games to date include:

- Axie Infinity — is a game revolving around ownership of animal creatures, Axies. Such creatures play to fight, construct on land and hunt for treasures. Participants may build a collection of Axies to be used in several games in the NFT space and receive rewards for their engagement in the platform.

- Dark Forest — is an Ethereum-based space conquest mini-game. Gamers’ purpose is to explore and conquer planets in an infinite universe that is cryptographically specified.

3. COLLECTIBLES

Since the dawn of time, humans have always exhibited a tendency towards collecting artefacts. From the prehistoric age when the primitive man used to collect objects like stone tools or pottery vessels for survival needs, to the civilised modern man we know today that displays penchant for works of art, antiques, figurines and other objects for the sole reason of aesthetics.

In this light, NFTs and their unique features bridge this inner human need in the NFT collectibles space. NFT Collectibles open up the possibility of expanding one’s physical collection into a larger digital one bolstered by immutable ownership.

To give you an idea, collectibles amount to around 31% of overall NFTs trading volumes which represent around $272 million since inception [13]. The most famous example of collectibles is CryptoKitties — a game centred around breedable, collectible creatures known as CryptoKitties where each kitten is one-of-a-kind, fully owned, inimitable, non-deletable and non-destroyable. In 2017, CryptoKitties constituted the first experimental attempt involving NFT collectibles.

Collectible kitties were sold in the form of NFTs and this has not been without success. In fact, the public’s enthusiasm for this initiative was so popular that it congested the entire Ethereum chain for a while. Each virtual cat, or token, has unique characteristics called “cattributes”. Some felines on the game are rarer than others, giving them a higher asset value on the marketplace.

Believe it or not, the renowned CryptoKitties’ Dragon was ranked as NFT’s top seller in 2018. The proceeds from the sale were as high as 600 ETH (more than $390,000) and it took a long time before other records were reached.

The reason why collectibles are getting so much interest is that, according to Ben Horowitz from venture capital firm Andreessen Horowitz, in this digital world, individuals aren’t buying the material that makes up the collectible, “they are buying a feeling”.

Kids in the 90s used to collect physical card games like Pokemon, POG, Magic The Gathering etc. Today’s children were both born and brought in the digital age. So it turns out that these practices are simply a natural extension of their playing habits and present the advantage for them of establishing these same card collections but this time in digital form. Some other popular collectibles are Crypto Punks, Crypto Kitties, NBA Top Shots, etc. Many collectibles are also available on platforms such as Rarible and Opensea.

4. METAVERSE & DIGITAL LAND

Capitalizing roughly $72 million in total trade volume since inception [14], metaverse and digital lands represent 8% of the NFT market. To give you an idea, the metaverse is, in a nutshell, the digital world where anything ever imagined is possible.

Each metaverse represents a separate parallel world, where one can buy land, build a house and hang out with friends. Metaverses sharply grew in popularity during COVID-19, as people weren’t able to hang out outdoors — this paved the way for a new social paradigm where NYE parties, concerts and art exhibitions were held in these metaverses. Nowadays, the metaverse is home for a small group of early adopters. In the words of author and entrepreneur Eric Elliott, the metaverse will soon become anchored in our daily lives by becoming an extension of our sensory faculties such as sight, sound and touch. Extended Reality (XR) is the name given to such technologies. Whether through the integration of digital objects into our real world or through immersion in fully engaging 3D environments at any given moment, the digital world is gradually becoming prominent for humankind [15].

The next step in the evolution of metaverses is the creation of a universally interoperable metaverse. In the real world one can travel from a country to another just by hopping on a plane or a train. In the omniverse one should be able to travel from a metaverse to another, with just an internet connection and a laptop. In that sense, the metaverse has the potential to reduce barriers to entry to a plethora of opportunities, then, exclusively accessible to a handful of privileged people in privileged locations.

The main metaverses at the moment are: Decentraland, CryptoVoxels, Somnium Space, The SandBox. For more details on the metaverses please check here.

5. OTHERS

This category represents roughly $7 million (1%) of overall NFTs trading volumes since inception [16]. This includes things like licensing, web domains, property titles, insurance. This is a residual category, such NFTs are mostly available on fully decentralized NFT platforms like Rarible and Opensea.

THE ENVIRONMENTAL IMPACT OF NFTs

NFTs have been criticized for the carbon impact they generate. It is important to outline that this is an existential concern predominantly related to the Ethereum blockchain where most NFTs are currently issued. Ethereum is built on a “proof-of-work” consensus, a mechanism that consumes a significant amount of energy every time a transaction happens and an NFT is minted.

While Ethereum 2.0, a highly anticipated transition to a “proof-of-stake” consensus will significantly reduce carbon emissions, it could take some time for it to be fully functional.

Ultimately, existing marketplaces will have to adjust and new ones will be built on more energy efficient blockchain platforms for the change to become more sustainable. A number of alternatives have already been built, such as the NBA Top Shot collectibles marketplace — launched by Dapper Labs and operating on the “proof-of-stake” FLOW blockchain [17].

It’s great to see that even in this current situation where the NFT community is mostly “proof-of-work” focused via Ethereum, a number of initiatives have been launched to raise awareness and capital to reduce the carbon footprint impact of NFTs.

For example, in March 2021 #CARBONDROP took place on Nifty Gateway, featuring artists such as Beeple, Refik Anadol, Sara Ludy, Mieke Marple, GMUNK, Kyle Gordon, Andres Reisinger and FVCKRENDER [18].

#CARBONDROP raised $6.5m for Open Earth Foundation. According to CryptoArt footprint, Nifty Gateway has emitted 13m KG of carbon. $150,000 offsets that, meaning Nifty Gateway is now carbon negative by 42x [19].

GENERATION Z: READY FOR THE NFT REVOLUTION

NFTs represent a disruptive innovation, but are we ready to fully embrace it? Even if we are not, data suggests that Generation Z — the newest generation, born between 1997 and 2012 definitely is.

According to a McKinsey report, digital born Generation Z is the most creative and authentic generation ever [20] and this has to do with the core centre of this Generation — the search for truth.

“Generation Z values individual expression and avoid labels. They mobilize themselves for a variety of causes. They believe profoundly in the efficacy of dialogue to solve conflicts and improve the world. Finally, they make decisions and relate to institutions in a highly analytical and pragmatic way. That is why, for us, Generation Z is “True Generation” In contrast, the previous generation — the millennials, sometimes called the “me generation” — got its start in an era of economic prosperity and focuses on the self. Its members are more idealistic, more confrontational, and less willing to accept diverse points of view” [21].

Generation Z is the first one born fully digital. They never lived in a world without the internet. Data suggests Generation Z is a very creative generation fully familiar with digital entertainment, creativity and with keen interest in gaming [22].

Below a few stats on Generation Z that suggests they are perfectly positioned to fully embrace NFTs to the fullest:

- More than 74% of Generation Z say they spend their free time online. (Institute of Business Management).

- Most of the Generation Z (73%) use their internet-connected devices to communicate with friends or family. Meanwhile, 59% and 58% also use them for entertainment and gaming respectively. (Institute of Business Management).

- 55% of Generation Z says they can be more creative on social apps and the internet than offline [23].

CONCLUSION: INTERNET 3.0 AND RENAISSANCE 2.0

In Greek mythology, Apollo and Dionysus are both sons of Zeus. Apollo is the god of the sun, of rational thinking and order, and appeals to logic, prudence and purity. Dionysus is the god of wine and dance, of irrationality and chaos, and appeals to emotions and instincts. The ancient Greeks did not consider the two gods to be opposites or rivals, although they were often entwined by nature.

Our society today is undoubtedly Apollonian — fully rational. Since our first day at school, we are taught the importance of competing with our peers in pretty much every aspect of life. How good we are at this, will determine our future. These frameworks become narrower through time as we identify the job we will dedicate most of our adult life to. From there onwards, we literally become our job.

This is considered normal, and it definitely does not leave much free time available during the day.

Despite the fact that productivity has been increasing exponentially for more than a century, working hours have remained pretty much constant [24].

Many studies show that income increases people’s subjective well-being only up to the point where basic needs are met. However, productivity has increased so much that we can have both the extra possessions and the extra time [24].

Putting this together with newer generations valuing authenticity and creativity among all, automation making many jobs redundant (with measures like Universal Basic Income probably being implemented at some point) and NFTs reducing barriers to entry to the creative industry, we now have a historical opportunity to move to a new paradigm where Apollo and Dionysus actually coexist, in a harmonious balance.

Nietzsche saw their fusion as ideal, as it allowed the tremendous frenzied energy of the Dionysian to be applied constructively inside an Apollonian framework. He thought the ancient Greeks, perhaps uniquely, were able to blend the two drives in their culture.

The Renaissance in Italy came after the plague. Today we are in the midst of a pandemic. A Renaissance 2.0 is possible if we embrace the NFTs to its fullest. This is not just a technological innovation, but a paradigm shift from a world that values status and curated social profiles towards a world that values creativity, authenticity and self-expression as its most important values. New generations have already started this journey, and now we have the technological means to put this into action. The future ahead is bright, and we should all feel fortunate to witness this historical chance to be part of this new paradigm.

References

[1] Gen Z and the NFT: Redefining Ownership for Digital Natives — June 2020

[2] StaffSquared: Why 85% of People Hate their Jobs — December 2019

[3] The Non-Fungible Token Bible: Everything you need to know about NFTs — January 2020

[4] Andreessen Horowitz: Crypto for Creators: From Art Galleries to ‘Tokenized’ Collectibles -

[5] Non Fungible: NFT Market History Overview & CryptoArt

[6] Trevor Jones Art: ETHBOY (AFTER PICASSO) FEAT. MONEY_ALOTTA

[7] Forbes: From Crypto To Christie’s: How Beeple Put Digital Art On The Map — And Then Catalyzed Its Market

[8] Nifty Gateway: Everything by 3LAU

[9] ArtNet News: Over 50 Percent of Art is Fake — October 2014

[10] Non Fungible: NFT Market History Overview & CryptoArt

[11] Investopedia: How Does Fortnite Make Money? — September 2020

[12] Medium: State of the Metaverse 2021 — January 2021

[13] Non Fungible: NFT Market History Overview & CryptoArt

[14] Non Fungible: NFT Market History Overview & CryptoArt

[15] Medium: State of the Metaverse 2021 — January 2021

[16] Non Fungible: NFT Market History Overview & CryptoArt

[18] #CARBONDROP — March 2021

[19] kylemcdonald/cryptoart-footprint — March 2021

[20] McKinsey: ‘True Gen’: Generation Z and its implications for companies

[21] Gen Z: Born to Be Digital

[22] McKinsey: ‘True Gen’: Generation Z and its implications for companies — November 2018

[23] 52 Gen Z Stats Marketers Need to Know in 2021

[24] Productivity and the Workweek — 2000s